Data-driven insights into post-pandemic manufacturing.

Manufacturers have experienced seismic changes in recent years. The pandemic is behind us, but it, along with events that have followed, have created new challenges globally.

They include economic uncertainty and supply chain disruption, labor issues, and fluctuating material, energy, and transportation prices. Sustainability is more important, and few manufacturers have yet to consider how tools like automation, IoT, and AI can help them.

While these challenges impact manufacturers differently according to their circumstances and decisions, data shows how the world’s manufacturing ecosystems have performed collectively under their influence.

FourJaw is used by manufacturers worldwide to capture real-time shop floor data, enabling them to identify where processes can be improved to drive productivity. Here, however, we assess productivity data at a broader level to show the impact of the pandemic and world events that followed.

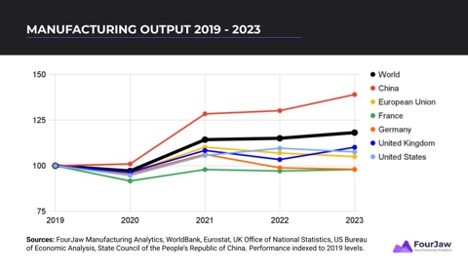

We considered World Bank data showing output from manufacturers globally between 2019 and 2022, plus other sources to shed further light on productivity and help us generate informed estimates for 2023.

Global output is 15 percent higher than pre-Covid, but growth has stalled

Unsurprisingly, productivity declined by three percent worldwide in 2020, before rebounding with an 18 percent growth surge in 2021. Since then, output has remained flat, increasing just one percent in 2022, as pent-up demand gave way to issues including chip shortages, labor issues, shipping disruptions, natural disasters, and war in Ukraine. Global manufacturing’s net output is now $16.19 trillion, 15 percent more than in 2019.

China emerges stronger and more productive

Chinese manufacturers, which delivered 31 percent of global output in 2022, encountered Covid-19 earlier and experienced lockdowns for longer than those in most other countries. After double-digit growth in preceding years, productivity declined by one percent in 2019, recovered in 2020 and soared by 27 percent in 2021.

Output growth slowed to one percent in 2022, and local sources suggest growth of seven percent in 2023. Despite two million fewer workers in the sector, Chinese manufacturers are 39 percent more productive now than in 2019 and up 42 percent on a per-worker basis.

Commentators credit this to higher-value activities, technology, and smarter working practices.

US productivity is up eight percent, manufacturers increase

In the US, output fell five percent in 2020 before growing 12 percent in 2021. The World Bank hasn’t shared US data beyond this, but local sources suggest manufacturers boosted output by another four percent in 2022.

US producers relied more heavily on recruitment to boost output. The Bureau of Labor Statistics reported 12.7 million US manufacturing workers in 2022, 500,000 more than in 2020.

We estimate US manufacturing productivity is eight percent ahead of where it was in 2019, and up six percent per employee, driven in part by policy changes that incentivized companies to re-shore manufacturing.

Productivity is challenged in Europe, some major markets are below pre-pandemic levels

In 2020 and 2021, manufacturers in EU countries experienced a similar collective performance to the US. What followed was different. EU manufacturing output fell by three percent in 2022 and local data indicates a further decline in 2023.

Production in Germany and France – two of Europe’s biggest manufacturing nations – is currently below pre-pandemic levels. When World Bank data becomes available for 2023, we anticipate it will show EU output five percent ahead of where it was in 2019, with employment increasing at the same rate,

Despite the gloom, some countries have achieved double-digit gains in productivity since 2019. They include Ireland, where 2022 manufacturing output was 61 percent above 2019 levels and increasing far faster than the corresponding workforce.

Some suggest the presence of many multinationals skew this figure, but we know Irish pharmaceutical and technology producers have achieved significant output gains in particular, and the Irish government is supporting efforts to accelerate technology adoption in manufacturing.

UK manufacturers buck slowdown, achieve productivity boom in 2023

Between 2019 and 2022, manufacturers in the UK experienced almost identical pressures and output patterns to their continental counterparts.

However, where EU figures suggest productivity declined in 2023, data from the UK’s Office of National Statistics indicate manufacturers here boosted productivity by seven percent, despite a reduced workforce. Producers here finished 2023 around ten percent more productive than in 2019 and 14 percent more per worker.

Some insiders credit Brexit for this. Less able to hire to increase production with people, manufacturers have more recently moved faster to boost output through automation and tools such as data analytics.

The pandemic and what followed caused many to rethink their priorities, and manufacturing is front and center of this change. Manufacturers around the world have shown great resilience and adaptability in the face of these challenges.

We see manufacturers meeting them with data and technology in factories worldwide. While some struggle, progressive producers are cutting costs and finding an extra ten percent, 20 percent, and even 30 percent within their existing facilities, equipment and headcount.

Future success is about working smarter. In many places, that future is here today. ■

By Chris Iveson

Chris Iveson is CEO of FourJaw Manufacturing Analytics. Founded in 2020 as a spinout from the University of Sheffield’s Advanced Manufacturing Research Centre, FourJaw is a UK-based SaaS company empowering manufacturers of all sizes to enhance productivity, reduce energy usage and grow more profitably. FourJaw’s plug-and-play machine monitoring platform integrates seamlessly with machines of any age or brand and is trusted by over 120 manufacturers globally, operating in sectors including aerospace, automotive, energy and food production.