November’s electronics market update from Techpoint

Consumer confidence globally remains dented by ongoing geopolitical uncertainty and, in the UK, slow economic growth. While consumer demand for electronics surged during the pandemic, realignment of this continues to impact lead times which are substantially decreased. For many products, these now sit at record lows across the past three years and by the end of 2023 our experts forecast these reaching normalcy.

Despite some products returning to much lower lead times, Techpoint recommends utilizing medium to long term planning wherever possible to mitigate disruption. Maintaining relationships and proactive communication across the supply chain will help all stakeholders as demand can be better measured and inventories managed. Failing to keep channels of communication open and clear may result in customers being pushed into Non-Cancellable Non-Returnable terms for their orders.

November Market Spotlight:

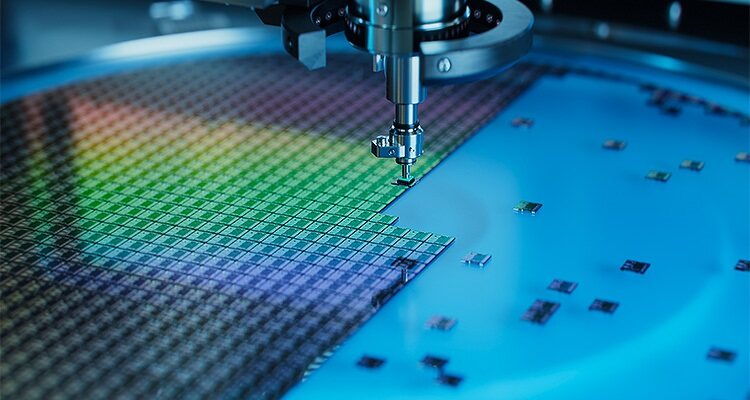

AI and semiconductors – Demand for artificial intelligence (AI) technologies has surged and this is set to continue. AI is incredibly energy-intensive, making semiconductor technologies critical to fueling the AI revolution of the future. Although the increased demand will be beneficial to electronics manufacturers, it will trigger a knock-on effect on the ‘bread-and-butter’ markets which means shortages across all electronic sectors.

The increase in AI investment will be like the Electronics Vehicle (EV) surge seen during the pandemic, which continues to have a lasting impact on chip manufacturers today. Despite the increased demand, chip manufacturers are unlikely to increase capacity significantly. Techpoint’s advice is clear, while lead times will ease, it is unlikely that they will return to pre-pandemic levels. We recommend keeping long-term order books and working closely with manufacturers and distributors as this is essential for effective planning and securing regular supply.

Lead times

As recent years have shown, it is prudent to prepare for potential disruption. Growing interconnectivity also means more points of friction, the pandemic chip shortages alone affected over 169 industries. Therefore, across the electrical supply chain, stakeholders should reduce their dependence on a single region by diversifying their suppliers and producers. Alternatively, onshoring promises more control over the total supply chain and minimizes global points of friction.