Innovations in battery manufacturing and their drivers By Dustin Bauer

ADDED VALUE

The rapid adoption of electric vehicles is reinforcing massive growth in battery manufacturing. For example, global demand for Lithium-Ion Batteries (LIBs) is set to grow from 360 GWh in 2021 to 3100 GWh in 2030, caused mostly by rising demand from the passenger and commercial vehicle sector.

OEMs in the automotive industry have demonstrated an increasing interest in vertical integration of the manufacture of not only battery packs and battery cells, but also battery materials. Recently, this has also extended to the equipment for battery cell and battery pack manufacture. This is in part caused by a lack of supply of manufacturing equipment. Increasing demand for LIBs and additional competition underlines the importance of protecting innovations in this field.

Various trends have persisted in battery manufacturing in recent years, particularly those seeking to make manufacturing more sustainable and more efficient. In electrode manufacturing, recovering solvents used for electrode coating may improve sustainability and also reduce costs. Dry coating of electrodes, on the other hand, seeks to eradicate the need for these solvents entirely. On the cell and battery pack side, recent developments include Tesla’s ‘tabless’ cells, manufacturing of mixed chemistry packs, and improved pouch cell degassing.

Patenting activity illustrates R&D trends in LIB manufacturing

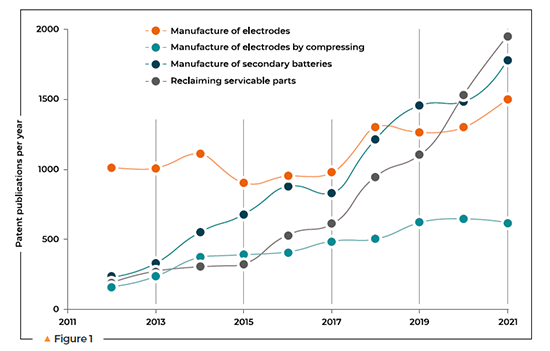

Perhaps unsurprisingly, over the past decade, the number of patents and patent applications being published related to the manufacture of electrodes (Cooperative Patent Classification CPC H01M4/04) and to electrode manufacturing involving compressing or compaction (CPC H01M4/043) such as dry coating, has increased significantly (see Figure 1). Publications relating to the manufacture of electrodes generally have increased from about 1000 in 2012 to about 1500 in 2021. In the same time period, publications relating to manufacturing involving compressing or compacting (including dry coating) have risen sharply from about 130 to over 600.

Similarly, the number of patent publications in CPC H01M10/04, related to manufacture of secondary batteries, has risen from about 230 in 2012 to nearly 1800 in 2021.

The increase in patent publications may be explained in part by new players entering the market. For example, automotive OEMs and battery start-ups and scale-ups are getting involved in battery cell and pack manufacture, as well as seeking to make their own equipment for manufacturing electrodes, battery cells, and battery packs. With increasing commercial opportunity and competition, protecting intellectual property in this field becomes ever more relevant.

Most patent publications in battery manufacturing are filed by the ‘usual subjects’ –large manufacturers such as LG, Samsung, Toyota, CATL, and Murata. However, when looking at the most recent publications (relating to inventions for which a patent application was first filed in 2020), automotive giants such as Volkswagen, and newer companies such as Prime Planet Energy & Solutions, Clever, and SVOLT, appear more frequently. It remains to be seen if this trend will continue.

Recycling

Material supply limitations and mineral price volatility are of increasing concern. In line with the End of Life Vehicle Directive, 95 percent of a vehicle by weight must be re-used, recycled or recovered. Although this Directive is not designed for electric vehicles, this is clearly the direction of travel and so revised requirements for electric vehicles appear inevitable. Achieving similar levels of sustainability for electric vehicles will require increased investment in re-use, recycling and recovery of LIBs.

Battery recycling poses many technical challenges, including different cell chemistries, and varying levels of cell degradation. One strategy for addressing some of these technical challenges is to build-in ‘recyclability’ at the point of manufacture, to facilitate recycling and recovery at end-of-life.

Soaring interest in battery recycling is borne out by a significant increase in the number of patent publications (see in Figure 1) related to reclaiming serviceable parts of accumulators (CPC H01M10/54), rising from below 200 in 2012 to nearly 2000 in 2021. Mining companies such as Sumimoto Metal Mining and JX Nippon Mining & Metals are the top filers, highlighting the importance of LIB recycling to materials suppliers. However, specialized companies such as Aqua Metals and Guangdong Brunp Recycling Technology (owned by CATL) are also well-represented.

Given increasing vertical integration of automotive OEMs and growing interest in built-in ‘recyclability’, one might expect automotive OEMs and battery manufacturers to increasingly appear on patent publications in this field.

Final thoughts

Manufacturing methods and machines are at the heart of enhanced battery cell and pack performance, increased manufacturing efficiency, and improved recyclability. With growing demand for battery manufacturing equipment, and limited supply, the impetus for OEMs and battery makers to manufacture their own manufacturing equipment will only increase. Given the combination of increasing demand and new competition, the value of intellectual property in this field will continue to grow.

For a list of the sources used in this article, please contact the editor.

Dustin Bauer

www.reddie.co.uk

Dustin Bauer is an Associate at Reddie & Grose LLP, an internationally renowned firm of European and United Kingdom patent, trade mark and design attorneys.

Its experienced team of nearly 80 IP professionals based in London, Cambridge, Munich and The Hague includes specialists in a wide range of technical disciplines. They handle the full range of IP rights for a global client base ranging from SMEs starting to consider IP through to large corporations with rights in over 100 countries.