Intel Offloads Altera Stake in $8.75B Silver Lake Deal

Subscribe to our free newsletter today to keep up to date with the latest manufacturing news.

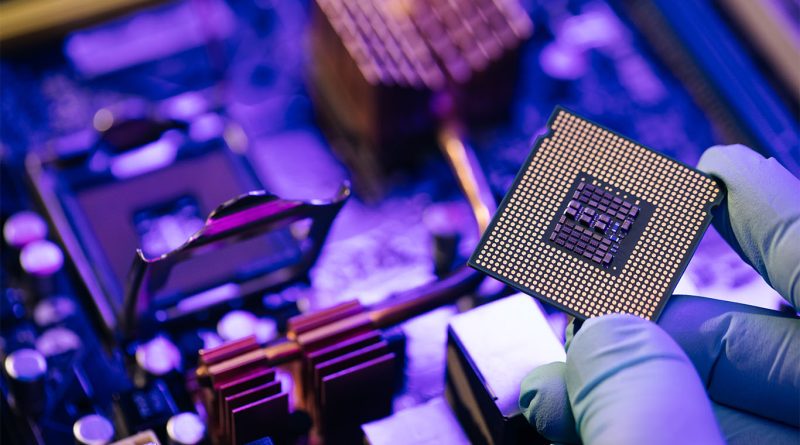

Intel has agreed to sell a 51 percent stake in its Altera programmable chip business to private equity firm Silver Lake for $4.46 billion. The deal, announced April 14, values the entire business at $8.75 billion and marks the first significant portfolio reshuffling under new CEO Lip-Bu Tan.

Intel will retain a 49 percent stake in Altera and maintain a partnership to support the company’s go-to-market capabilities. The transaction is expected to close in the second half of 2025. At that point, Altera’s financials will no longer be included in Intel’s statements, a change that will immediately improve Intel’s reported operating margins and streamline its financial reporting.

Why Altera? Understanding the business unit’s role and history

Intel acquired Altera in 2015 for $16.7 billion, aiming to diversify beyond traditional CPUs through programmable logic devices. At the time, FPGAs (field-programmable gate arrays) were gaining traction in telecommunications, automotive, and defense markets.

In recent years, Altera’s alignment with Intel’s strategy declined. Market volatility compressed margins, and Altera’s contribution to Intel’s revenue fell. Intel’s increasing focus on foundry services and contract manufacturing diverted capital and attention from earlier acquisitions.

Silver Lake steps in as private equity deepens its role in legacy tech

Silver Lake’s acquisition reflects private equity’s expanding interest in mature technology assets. The firm, known for backing Dell Technologies and Motorola Solutions, aims to leverage Altera’s capabilities in data center and edge computing environments.

Operating independently from Intel, Altera is expected to prioritize customer-specific development and target sectors where flexibility in chip design offers a competitive edge.

Leadership transition sets Altera’s new direction

Raghib Hussain, formerly with Marvell Technology, will become Altera’s CEO on May 5. He replaces Sandra Rivera, who will return to a senior executive role at Intel. Hussain’s background in networking and integrated systems positions him to guide Altera through its next stage of growth.

With the leadership change and separation from Intel’s financials, Altera gains the opportunity to define its strategy, allocate capital more precisely, and respond quickly to market shifts.

This transaction is part of a broader effort by Intel to streamline operations and rebuild profitability. Under Lip-Bu Tan, the company is emphasizing manufacturing innovation, core chip development, and financial stability. Selling a controlling interest in Altera helps reduce operational complexity while generating immediate cash flow.

The deal is scheduled to close in the second half of 2025, pending regulatory clearance. Afterward, Intel expects improved profit margins and a more focused business profile. Silver Lake will guide Altera toward growth areas like AI hardware, 5G systems, and industrial applications.