Metal additive manufacturing market set to exceed $13B by 2035

Subscribe to our free newsletter today to keep up to date with the latest manufacturing news.

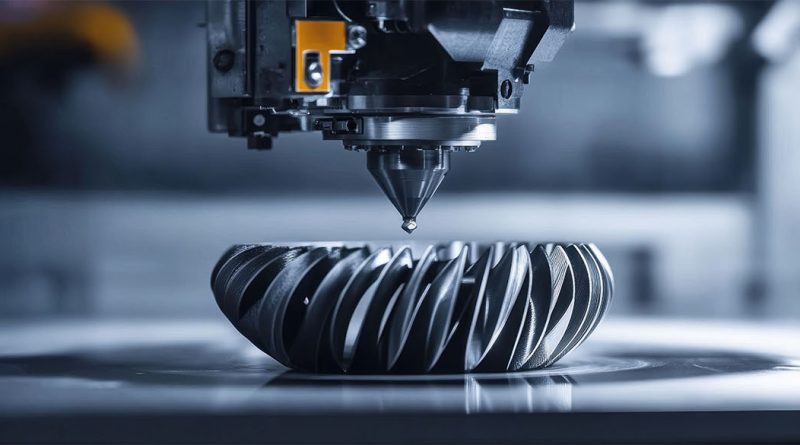

The global metal additive manufacturing industry is experiencing a significant shift as it evolves from its prototyping roots into full-scale production across a wide range of industrial sectors. This transformation is backed by substantial market forecasts. Analysts project that the metal AM sector will grow from approximately $6.68 billion in 2025 to $13 billion by 2035, supported by a compound annual growth rate of nearly 10.4 percent. This surge reflects growing confidence in 3D printing’s ability to meet the rigorous demands of production environments.

As companies reassess how they design and produce components, particularly in cost-sensitive or heavily regulated sectors, metal AM is proving increasingly viable. The movement toward production-level adoption marks a departure from early-stage experimentation. Manufacturers are now integrating 3D printing as a strategic component of their production workflows.

A closer look at key sectors fueling adoption

The aerospace and defense industries were among the first to validate the performance and reliability of metal AM. Today, they continue to lead adoption, using the technology to create lightweight, structurally optimized parts that cannot be manufactured using traditional techniques. These parts include heat exchangers, turbine blades, and internal engine components that benefit from AM’s ability to reduce weight and enhance thermal performance without compromising strength.

In the automotive sector, manufacturers are moving beyond the R&D phase. As the industry focuses on electrification and mass customization, 3D-printed metal parts enable simplified component design and reduced assembly complexity. This shift improves turnaround time and supports faster iteration across new vehicle platforms.

The medical field is also advancing its use of metal AM, particularly for patient-specific implants and surgical instruments. With additive processes, customization becomes cost-effective, especially when working with materials like titanium and cobalt-chrome. Hospitals and device manufacturers are beginning to recognize these benefits across orthopedic and dental applications.

Market forecasts reveal explosive potential by 2035

By 2035, the global metal AM market is expected to reach $13 billion, nearly doubling from current levels. North America currently holds over 40 percent of global share, with strong demand from aerospace, automotive, and government-backed research initiatives. In the United States alone, the market is projected to grow from $2.05 billion in 2025 to $6.65 billion by 2034.

China is also emerging as a key growth hub. Investments in smart manufacturing infrastructure and government-led initiatives to localize supply chains are accelerating adoption in heavy machinery, transportation, and energy sectors.

Material and hardware revenues are expanding alongside this trend. With declining equipment costs and more accessible training resources, small and mid-sized manufacturers are entering the market. Meanwhile, advances in material science continue to unlock a wider range of printable metals, including stainless steel, Inconel, and copper.

How evolving technologies are shaping metal AM capabilities

Laser Powder Bed Fusion remains the most widely used process in metal AM, valued for its accuracy and structural strength. This technique is particularly suited to aerospace and medical applications where tolerance and repeatability are critical.

Metal Binder Jetting, another promising method, is gaining popularity among companies that require high throughput and lower per-part costs. Unlike fusion-based methods, it allows for batch production of parts that are later sintered to achieve full density.

Cold spray additive manufacturing, which bonds metal particles without melting them, has proven useful in defense applications. This process allows for rapid repair of high-performance components and is already being used in the field to replace broken parts with limited supply availability.

Bound metal extrusion is also lowering the entry barrier by combining metal powders with polymer binders, allowing companies to use standard extrusion printers for metal part fabrication.

Moving beyond prototyping: what manufacturers are doing differently

Manufacturers are no longer treating metal AM as a lab tool. In defense environments, for instance, companies like SPEE3D have deployed printers to remote military sites to fabricate vehicle parts and components on-demand. These units reduce dependence on traditional logistics chains and dramatically speed up repair operations.

Industrial firms are also using metal AM for end-use parts and production tooling. In factories where part obsolescence or supply chain lag can halt operations, metal AM enables just-in-time manufacturing. This not only reduces inventory but allows for component redesign without needing retooling.

Across industries, the focus is now on building additive workflows that operate in parallel with traditional processes, giving companies the flexibility to adapt as demand changes.

Although growth prospects are high, manufacturers must overcome several obstacles to scale metal AM effectively. Materials remain expensive, especially exotic alloys needed for high-stress or biocompatible applications. Certifying parts for use in regulated sectors can also be complex and time-consuming.

Designing for additive rather than subtractive manufacturing requires a different skill set. Companies must train teams in topology optimization, powder handling, and post-processing techniques. Additionally, integrating metal AM with digital manufacturing systems requires investment in software, simulation, and quality monitoring tools.

Despite these barriers, the long-term benefits are compelling. Metal AM enables new geometries, faster iteration, and reduced material waste. As machines become more versatile and automation increases, additive production will play a larger role in reshaping how industries approach product development and supply resilience.

Sources