Over the last four years, Porvair Filtration has adapted and thrived

Under its parent company, Porvair PLC, Porvair Filtration Group (PFG) works alongside Porvair Sciences, Selee Corporation, and Seal Analytical to meet the demands of three key verticals: aerospace and industrial, laboratory, and metal melt quality. Although the organization itself primarily bases its manufacturing between the UK and the US, its geographical footprint extends across the entire globe, in serving the aviation, molten metal, energy, water treatment, and life sciences markets. We last spoke to PFG back in 2019, so Manufacturing Today sits down with Tom Liddell, Managing Director, to hear how the business is settling into the new normal.

Investing in efficiencies

Investing in efficiencies

“Obviously, since we last spoke, PFG has experienced a great deal of change,” Tom opens. “Although we all felt the pinch of the pandemic, our industry was hit particularly hard on account of its exposure to the aerospace market. The short term fluctuation in demand was greater than anything we’ve ever experienced before, and required a huge effort from the management teams in terms of scaling the organization, whilst safeguarding our employees from the newfound risks of Covid. It really forced us to focus on which critical operations to maintain, and to heavily invest in our efficiencies, in the absence of revenue growth.

“Despite the significant challenges that the period presented us with, it also revealed a number of strong opportunities. Whilst some areas of our market were depressed and over-stocked, others, such as life sciences and microelectronics, were driven to seek out new supply chains in a market where materials were increasingly scarce, costs were rising, and lead times were getting longer. The manufacturers with the cash to invest in stock were able to capitalize on their dwindling competitors, and find new customers and take a greater portion of the market share. In contrast to this, there were times when the government advice seemed almost deliberately ambiguous, and it was down to our managers to ensure consistency, fairness, and concern were all maintained towards our employees. Overall, I’m incredibly proud of what we achieved over the last three years; our top line has recovered, and PFG has scaled back up more efficiently than its former self.”

Enhanced output

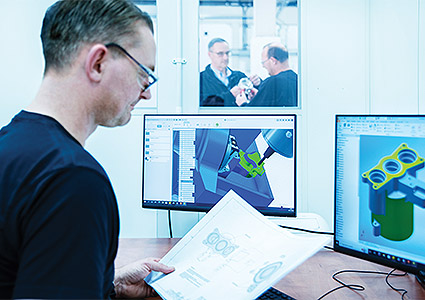

As a result of the pandemic, the organization had to reduce its headcount by almost 20 percent. Consequently, it is turning to automation to resolve the labor deficit. “The shift in our focus, regarding our operational efficiencies, was primarily due to the implausibility of traditional sales methods, which removed a number of our regular avenues for growth. It also became clear that we were going to have to scale the business, without scaling our workforce, which naturally led us to considering investments in automation and digitization.

“Since then, we have invested greatly in processes that can run lights out, or with minimal supervision,” Tom continues. “Two good examples would be in machine tools and laser cutting equipment for sheet materials. Regardless of the increased complexities in establishing them, modern machines deliver a greater output, of more intricate elements with higher rates of consistency, than would be affordable or feasible with human counterparts. They are also becoming more integrated with our other upstream and downstream processes, such as engineering and part inspection.”

A growing team

Over recent years, PFG’s levels of investment in its China-based operations have begun to ease, despite the company still continuing to trade there. This has been in lieu of other opportunities developing further, such as its business in India that has continued to grow successfully. “Our Indian entity has proven to be far more important to us in the post-pandemic market, as it allows us to access a wealth of technical skills that have become more scarce in Europe and the US. We don’t manufacture there per say, as our focus is more centered around the technically differentiated end of what we supply, but we still see a sustainable and profitable enterprise, and a growing team, in Mumbai, which is adding value to the company worldwide.”

Market penetration

In 2019, Porvair PLC acquired Royal Dahlman, a Netherlands-based supplier of tailor-made solutions for the process industry all over the world. “The acquisition has been great for us,” Tom explains, “as it has brought the group a number of immediate benefits. For one, its business in the petrochemical market has given us penetration in a segment we have not previously focused on, and their reputation in Benelux has been something we have been able to leverage with our wide range of filtration products. The work it has been doing with our team in India has been particularly successful, as it has given Royal Dahlman access to a local supply chain, and an opportunity to introduce its specialist offerings into the growing oil and gas sector. Furthermore, possessing an entity in the EU has also been important post Brexit, as it has ensured that we can continue to trade competitively, and minimized our exposure to the increase in costs of freight and indirect taxation.

“I recently completed my 15th year with PFG,” he concludes, “and I am still regularly surprised and interested by the diversity of what we do. As the business has grown, it has given me an excellent opportunity to grow alongside it, and although the market is still unpredictable, 2023 has begun well for us, and our order book gives us good reason to be optimistic about the future.”