Pioneering sustainable cash management, Cash Processing Solutions continues to epitomize the true meaning of reform

Cash processing is the backbone of the modern economy. Technologies such as ATM machines and bank note sorting and counting machines revolutionized the industry and are widely regarded as essential equipment, but have you ever wondered where it all started?

Cash Processing Solutions’ (CPS) journey began back in 1957 when it launched the very first banknote counting machine, and then the first ATM machine just ten years later – two inventions that changed the world’s approach to cash handling forever.

Fast-forward 60 years and CPS is the world-leading provider of bulk cash processing hardware and software solutions. Manufacturing Today sat down with Barrie Foley, Chief Executive Officer at CPS, to learn more about the business’ background, its current transformation strategy and how it pioneers new sustainable cash management.

Fast-forward 60 years and CPS is the world-leading provider of bulk cash processing hardware and software solutions. Manufacturing Today sat down with Barrie Foley, Chief Executive Officer at CPS, to learn more about the business’ background, its current transformation strategy and how it pioneers new sustainable cash management.

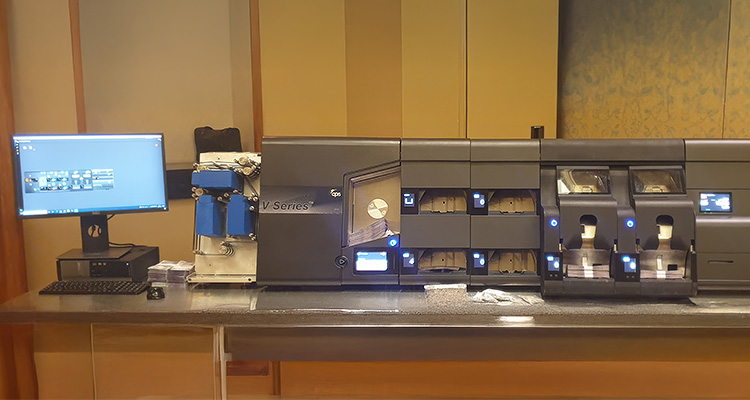

“We manufacture cash machines that are fit for purpose, that look at the authenticity and verification of cash and look for fraud,” Barrie begins. “These are hardware machines that are used by all the central banks, retail banks, casinos, and cash-in-transit companies. We also have the software that sits in retail outlets and banks in different areas of the cash cycle.”

Whilst many argue that cash is a declining sector due to digitalization and new technologies, Barrie acknowledges the inevitability and importance of cash use.

“In the UK, we tend to use cards, but cash is used all over the world, and is very much linked to how countries are structured. Where there’s no infrastructure, they want cash,” Barrie explains. “Whilst the UK is different to these countries, cash is certainly a growing sector. Cash was very important during Covid; cash is here to stay.”

Transformation strategy

As the cash sector continues to evolve, CPS has employed a unique transformation strategy to stay ahead of the curve and address some of the challenges that the business was experiencing. One of the challenges was the impact of its high-cost manufacturing facilities on profitability.

“We found that it was very difficult to have manufacturing facilities in Dallas and in the UK, and a big headquarters in Basingstoke. These big facilities were taking all the profits away,” Barrie reveals.

“We were finding that it was very high cost to manufacture, so, in 2023, we reorganized and closed the headquarters and the manufacturing facility in Dallas. We purchased all the assets from Cash Processing Solutions and maintained key people. At the same time, we also bought all the patents, and we restructured the group.

“We separated the Enterprise Cash Management software from CPS and introduced a new global manufacturing facility. Now, we’ve got around 400 people across the world. Our customers are companies like the Bank of England, the Bank of Canada, the Bank of Iraq – all the major central banks – as well as HSBC and NatWest.”

Alongside operational restructuring, sustainability is another key pillar of CPS’ transformation strategy. “We found that those big machines that we’re selling aren’t very environmentally friendly,” Barrie shares. “Our machines are made of aluminum, and they’re between one and two tons in weight, and that’s 11.5 tons of CO2 for every ton of aluminum, so the industry was actually embracing a bad environmental footprint. We thought we could change that and asked ourselves ‘how do we take on the bigger players?’, and our solution was sustainable cash processing.”

After assessing its sustainability approach and the needs of its clients, CPS investigated different types of green machines with a smaller footprint and decreased power consumption, and offered its customers two solutions.

“We gave our customers two options. The first one: don’t buy new – keep the big machines and upgrade them,” Barrie describes. “We’ve had machines out there since 1988, but they’re all fully equipped with high specification cameras, magnetic detector systems, and upgraded with up-to-date systems. That’s the first choice to keep your green strategy online. The second strategy is that, if you do want to change your machines, buy different machines, smaller machines, less power-driven machines.

“The central banks are very cost-conscious and, additionally, very environmentally conscious because of the pressure on governments, but the cash-in-transit companies are all about efficiency and how many less people they can use to move these notes around the world. We can tick both boxes with efficiency and sustainability. That was our drive to market and changing the industry; this is our challenge. We can talk about manufacturing processes and what the notes are made of, but you’re only going to get a greener solution if you can reduce the power and actually improve efficiency.”

Fighting fraud

Constant innovation is quintessential to both CPS and its customers alike, not merely for efficiency purposes but to stay ahead of scammers and fraud. Digital data and evolving technologies are crucial to preventing cash crime.

“Digital is at the forefront of our strategy,” says Barrie. “Banks stay ahead of the fraudsters by changing the design of their note. The banks supply us with their sensors, and banks are continuously redesigning their templates. Therefore, our technology has got to find different ways. In the old days, attempts were made to photocopy a five-pound note. Nowadays it’s pretty tough.

“The second issue is AI. The banks stay ahead of AI, but they can never be completely ahead of fraudsters. When it comes to coding, you have to be a bit more careful because it opens up a whole regime, so it’s important that banks bring in standardization where they can.

“As for algorithms and intelligence machinery? AI is just going to speed that up a bit more. But we need to move quicker to actually make sure we stay ahead of the game.”

As newer innovations such as AI continue to develop, CPS intends to stay one step ahead and maintain its position as the global leader in cash processing. The business is looking to expand further into the retail sector and develop technologies that go beyond hard cash. The economy and cash sector are ever-changing, but one thing is certain: CPS will remain at the forefront of the industry.